How to confirm if Pan Card is Valid

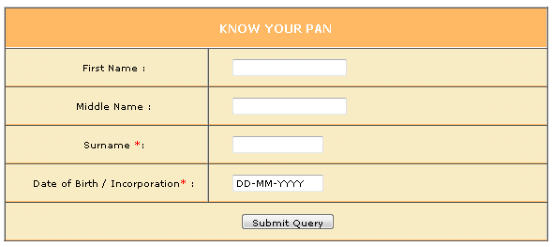

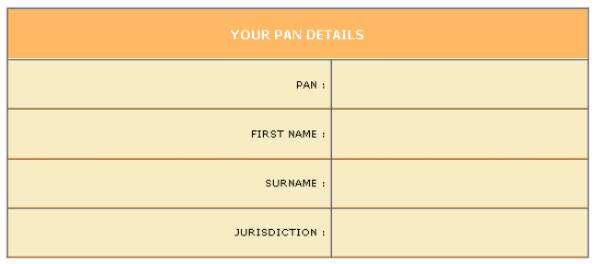

There are times when a Pan card holder may wish to confirm the validity of their Pan Card and ensure that the tax office has your correct record. Quite often, agents are getting involved in helping people get Pan Cards for a fee. How does one check if a Pan card is valid! Check Pan Card Validity Online Now, Pan card details can easily be checked online. The procedure is simple and fast, courtesy of the Income tax department of India. Here is how to check: • Log on to the income tax website by clicking HERE or you can type the url: https://incometaxindiaefiling.gov.in/portal/knowpan.do in your browser. • You will see a form with the title, ‘KNOW YOUR PAN’ (See sample of form shown) • No login is required to know your Pan Information. When you open the page on your browser, you are logged in as a guest • Enter your first, middle and surname in the appropriate boxes. Names should be entered exactly as shown on your Pan Card. • Ensure that the spelling is correct. • If you do not have a middle name, leave the column blank • Enter the date of birth. Enter only in the format shown on the form. • Click the Submit Query button. If the information was entered correctly, you will be taken to a page showing your Pan Card information. (See sample shown below) In case you get an error, recheck the spelling and ensure that the date format you entered is correct. In case you see an error somewhere, report the information to the income tax department to get it rectified. Information changes/corrections can be made to Pan Cards by submitting requests online also, by using the appropriate form.

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has

been stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

How to get Nativity Certificate in India | Proof of Indian Origin . . .

Who exactly is considered to be a Person of Indian Origin . . . . . .

NRI - OCI - PIO Guide & Information

How to confirm if Pan Card is

Valid

There are times when a Pan card holder may wish to confirm the validity of their Pan Card and ensure that the tax office has your correct record. Quite often, agents are getting involved in helping people get Pan Cards for a fee. How does one check if a Pan card is valid! Check Pan Card Validity Online Now, Pan card details can easily be checked online. The procedure is simple and fast, courtesy of the Income tax department of India. Here is how to check: • Log on to the income tax website by clicking HERE or you can type the url: https://incometaxindiaefiling.gov.in/portal/knowpan.do in your browser. • You will see a form with the title, ‘KNOW YOUR PAN’ (See sample of form shown in desktop version) • No login is required to know your Pan Information. When you open the page on your browser, you are logged in as a guest • Enter your first, middle and surname in the appropriate boxes. Names should be entered exactly as shown on your Pan Card. • Ensure that the spelling is correct. • If you do not have a middle name, leave the column blank • Enter the date of birth. Enter only in the format shown on the form. • Click the Submit Query button. If the information was entered correctly, you will be taken to a page showing your Pan Card information. (See sample shown below) In case you get an error, recheck the spelling and ensure that the date format you entered is correct. In case you see an error somewhere, report the information to the income tax department to get it rectified. Information changes/corrections can be made to Pan Cards by submitting requests online also, by using the appropriate form.

Disclaimer: Information provided is for general knowledge only and should not be

deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do

change from time to time. Please note that in case of any variation between what has

been stated on this website and the relevant Act, Rules, Regulations, Policy Statements

etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com