Step by step information - how to link your PAN card to Aadhaar Card

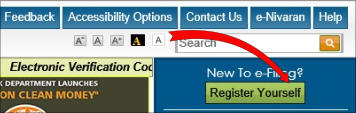

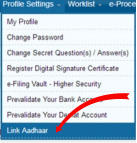

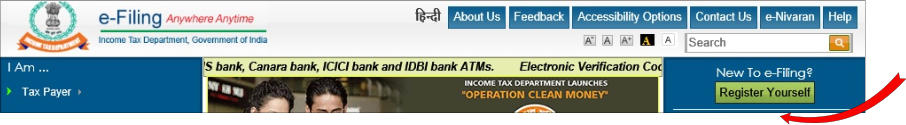

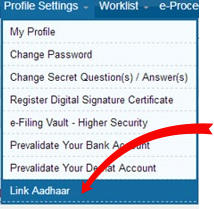

NRIs,OCIs & PIO can link their current PAN card to Aadhaar Card Following amendments under ‘The Finance Bill 2017’ from July 1, 2017: Every taxpayer will have to quote his/her Aadhaar Card number when filing their income-tax returns in India. To get a new PAN card applicants will have to provide their Aadhaar Card Numbers. Those who already have PAN cards will have to link their PAN cards to their Aadhaar Cards or in the near future their PAN cards may be canceled. [ No confirmed cancellation date yet when this will take effect other than rumors] How to Link PAN to Aadhaar Card How do individuals link their PAN cards to their Aadhaar Card? The procedure is fairly simply for those who have previously filed taxes and are registered on the income tax e-filling portal. Those who are not registered need to first register and this step by step procedure is explained in detail in this article. Here are the steps for those already registered with tax department and have login ID & password: Log in to the e-Filing portal of the Income Tax Department https://incometaxindiaefiling.gov.in/ by entering your log-in credentials [user ID and Password created when registering at the e-filling portal] When you login, a pop-up window will appear prompting you to link your PAN card to your Aadhaar card. In case such a pop-up does not occur then simply use the menu under ‘Profile Settings’ and Select ‘Link Aadhaar’ [see image with Red Arrow] Follow the prompts and fill in the required information accurately. Enter your Aadhaar card number and click ‘Link Now’. If all the information was submitted correctly, a message acknowledging successful linking of your PAN will be displayed. Procedure to link PAN to Aadhaar for those NOT registered with tax department e-filling portal First you need to register to get a user ID and create a login password. To do this go to https://incometaxindiaefiling.gov.in/ On the top right corner use the ‘Register Yourself’ link to start the registration. [See image below] Start filling the Registration Form by selecting the user type that applies to you [example individual or company etc.] click ‘Continue’ Fill in the required information such as PAN, Surname, Date of birth, Middle Name if applicable, First Name. The select date of birth from drop down menu and click Continue Next page will display your new user ID. Fill in the required information on this page and create a secure password. You will have to provide your address, valid email ID and a mobile telephone number. Once all information is filled in enter in the Captcha fields and Submit A message will be displayed saying ‘Thank you for registering in e-Filling’ A One Time Password PIN [OTP] is sent to your mobile phone and a link to activate your account has been emailed to you Log in to your email account, click the activation link in the email you received and enter the Mobile Pin [OTP] you received in your mobile phone and click Submit. You will then see a display that says ‘The User ID is successfully activated’ Now after registering, use the steps mentioned earlier and link your PAN Card to your Aadhaar Card. How NRIs, OCI & PIOs can link PAN Card to Aadhaar While the procedure to link their existing PAN card numbers to their Aadhaar cards is the same for everyone, for those persons who live abroad and hold PAN cards, the online linking procedure has one hurdle that a mobile phone number is required as this number is used by the authorities to send text message containing the OTP PIN to complete the registration process. Those living abroad do not have Indian mobile numbers, however the authorities have provided relief to non-residents . For registration on the e-filling portal purposes, according to a Ministry of Finance press release, ‘For ‘Foreign/ NRI’ taxpayers, the OTP validation of the email ID would be sufficient.’ hence when filling the registration form, NRIs can simply select that they are Non-Residents. [see image with blue arrow] [To view copy of press release click here] More on PAN Cards Cancellation for those who do not file taxes or do not have Aadhaar Cards • Will those who do not have Aadhaar Cards have their PAN cards canceled? • How can NRIs, OCI, PIO get Aadhaar card from abroad? Click HERE to view article >>

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has

been stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

NRI - OCI - PIO Guide & Information

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com

Step by step information - how

to link your PAN card to

Aadhaar Card

NRIs,OCIs & PIO can link their current PAN card to Aadhaar Card Following amendments under ‘The Finance Bill 2017’ from July 1, 2017: Every taxpayer will have to quote his/her Aadhaar Card number when filing their income- tax returns in India. To get a new PAN card applicants will have to provide their Aadhaar Card Numbers. Those who already have PAN cards will have to link their PAN cards to their Aadhaar Cards or in the near future their PAN cards may be canceled. [ No confirmed cancellation date yet when this will take effect other than rumors] How to Link PAN to Aadhaar Card How do individuals link their PAN cards to their Aadhaar Card? The procedure is fairly simply for those who have previously filed taxes and are registered on the income tax e-filling portal. Those who are not registered need to first register and this step by step procedure is explained in detail in this article. Here are the steps for those already registered with tax department and have login ID & password: Log in to the e-Filing portal of the Income Tax Department https://incometaxindiaefiling.gov.in/ by entering your log-in credentials [user ID and Password created when registering at the e-filling portal] When you login, a pop-up window will appear prompting you to link your PAN card to your Aadhaar card. In case such a pop-up does not occur then simply use the menu under ‘Profile Settings’ and Select ‘Link Aadhaar’ [see image with Red Arrow] Follow the prompts and fill in the required information accurately. Enter your Aadhaar card number and click ‘Link Now’. If all the information was submitted correctly, a message acknowledging successful linking of your PAN will be displayed. Procedure to link PAN to Aadhaar for those NOT registered with tax department e-filling portal First you need to register to get a user ID and create a login password. To do this go to https://incometaxindiaefiling.gov.in/ On the top right corner use the ‘Register Yourself’ link to start the registration. [See image below] Start filling the Registration Form by selecting the user type that applies to you [example individual or company etc.] click ‘Continue’ Fill in the required information such as PAN, Surname, Date of birth, Middle Name if applicable, First Name. The select date of birth from drop down menu and click Continue Next page will display your new user ID. Fill in the required information on this page and create a secure password. You will have to provide your address, valid email ID and a mobile telephone number. Once all information is filled in enter in the Captcha fields and Submit A message will be displayed saying ‘Thank you for registering in e-Filling’ A One Time Password PIN [OTP] is sent to your mobile phone and a link to activate your account has been emailed to you Log in to your email account, click the activation link in the email you received and enter the Mobile Pin [OTP] you received in your mobile phone and click Submit. You will then see a display that says ‘The User ID is successfully activated’ Now after registering, use the steps mentioned earlier and link your PAN Card to your Aadhaar Card. How NRIs, OCI & PIOs can link PAN Card to Aadhaar While the procedure to link their existing PAN card numbers to their Aadhaar cards is the same for everyone, for those persons who live abroad and hold PAN cards, the online linking procedure has one hurdle that a mobile phone number is required as this number is used by the authorities to send text message containing the OTP PIN to complete the registration process. Those living abroad do not have Indian mobile numbers, however the authorities have provided relief to non-residents . For registration on the e-filling portal purposes, according to a Ministry of Finance press release, ‘For ‘Foreign/ NRI’ taxpayers, the OTP validation of the email ID would be sufficient.’ hence when filling the registration form, NRIs can simply select that they are Non-Residents. [see image with blue arrow] [To view copy of press release click here] More on PAN Cards Cancellation for those who do not file taxes or do not have Aadhaar Cards • Will those who do not have Aadhaar Cards have their PAN cards canceled? • How can NRIs, OCI, PIO get Aadhaar card from abroad? Click HERE to view article >>