Q.954 Minimum Income Requirements to File US Federal Income Tax Return

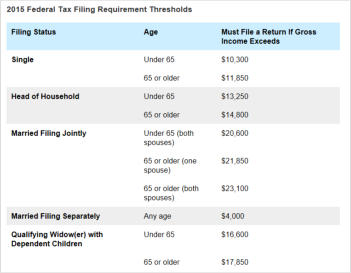

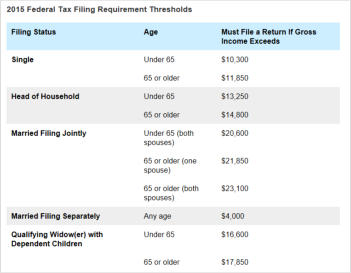

Question: Dear Sir: Can you please provide the reference (IRS Publication number) in regards to the contents of your reply to question # 501 as narrated in para 2 (reproduced below for ready reference)? I have tried to do many 'searches' on IRS website but had no luck. I am a US citizen and 73 years of age. My other question is on the significance of year 2012. Is it also for the subsequent years? The rules for filing taxes in the United States are the same for US citizens whether they live in USA or live abroad. Whether a person has to file a tax return in USA or not depends on the persons age and income. Even though the IRS requires that all worldwide income be declared when filling US taxes, generally, a person who is over 65 years of age or older must file a return for 2012 if their gross income from worldwide sources is at least $11,200. If your income is $11,200 (convert Rupees to US$) then you must file US taxes and declare your Pension or any other income received by you. The IRS has a very informative website and you can check it if you have any questions regards to filing US taxes. Your response will be greatly appreciated. Regards Answer: The question you refer to is several years old. While I do not have a link to the 2012 IRS page currently, here is an excerpt from IRS website for 2015 Federal tax filing requirement shown below. This shows information such as that single persons 65 or older must file a tax return if gross income exceeds $11,850 etc. You can view the full IRS website page by clicking HERE. Once on the IRS website page shown on the link, you can use the menu on the left hand side for additional information you require or use the search box provided on the IRS web page for other tax related info. I hope this is the information you are looking for.

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has been

stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

Information

by Virendar Chand

NRI - OCI - PIO Guide & Information

NriInformation Questions &Answers

Read Disclaimer at bottom of page

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com

Q.954 Minimum Income

Requirements to File US Federal

Income Tax Return

Question: Dear Sir: Can you please provide the reference (IRS Publication number) in regards to the contents of your reply to question # 501 as narrated in para 2 (reproduced below for ready reference)? I have tried to do many 'searches' on IRS website but had no luck. I am a US citizen and 73 years of age. My other question is on the significance of year 2012. Is it also for the subsequent years? The rules for filing taxes in the United States are the same for US citizens whether they live in USA or live abroad. Whether a person has to file a tax return in USA or not depends on the persons age and income. Even though the IRS requires that all worldwide income be declared when filling US taxes, generally, a person who is over 65 years of age or older must file a return for 2012 if their gross income from worldwide sources is at least $11,200. If your income is $11,200 (convert Rupees to US$) then you must file US taxes and declare your Pension or any other income received by you. The IRS has a very informative website and you can check it if you have any questions regards to filing US taxes. Your response will be greatly appreciated. Regards Answer: The question you refer to is several years old. While I do not have a link to the 2012 IRS page currently, here is an excerpt from IRS website for 2015 Federal tax filing requirement shown below. This shows information such as that single persons 65 or older must file a tax return if gross income exceeds $11,850 etc. You can view the full IRS website page by clicking HERE. Once on the IRS website page shown on the link, you can use the menu on the left hand side for additional information you require or use the search box provided on the IRS web page for other tax related info. I hope this is the information you are looking for.

NriInformation FAQ

Read Disclaimer at bottom of page