Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has been

stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

N

RI Information

Informing

educating and connecting Indians across the globe . . . by Virendar Chand

NriInformation Questions &Answers

Read Disclaimer at bottom of page

Q663. Reduction of customs duty on gold taken to India?

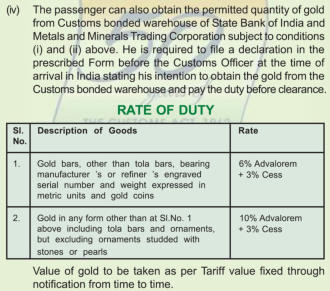

Question: Dear Virender Ji, From your website it appears that the govt has recently reduced the duty on gold bars from 10% to 6% + 3% tax -does this equate to total 6.18%? -Is there anywhere that I can get hold of the official notification that I can carry with me when travelling into Delhi-just in case they still want to still impose 10% -does the duty free allowance ( Rs 100,000 females/Rs. 50,000 males) apply to gold bars as well? an early reply will be highly appreciated. Anil Sood Australia Answer: I am not sure how you got the impression that customs duty on gold taken to India has been reduced from 10% to 6%? Perhaps, you are confusing gold bars with gold jewelery! 1. Passengers arriving in India with gold bars are charged customs duty @ 6 per cent ad valorem plus 3 per cent tax. 2. Passengers carrying gold jewelry are charged 10% customs duty plus 3% taxDuty Free Allowance

Duty free allowance, Rupees 100,000 for lady passengers and Rupees 50,000 for gentlemen applies to only gold jewelery.Printing out notifications as proof

To find official notifications you should go to the Indian customs website. However keep in mind that rules and regulations can be changed by the government of India at anytime. Quite often I find that some websites are not updated immediately and show outdated information. For example, even though a few customs websites still show that 10 Kg of gold can be brought in, the limit is 1 Kg. Any passenger who decides on the basis of the information posted on some website, even if it is a government website, to take 10 Kg of gold to India, is in for a rude awakening! a printout from a website would be of no use under such circumstances. Ignorance of the law is never accepted as an excuse. On April 18, 2012 the government reduced the amount allowed to 1 Kg. Many websites still continue to show 10Kg! To see the government notification CLICK HERE Readers should check and confirm what they read on any website, including my website, before acting on the information provided! • Disadvantage of acquiring foreign citizenship by NRIs settled abroad >> • Advantages of acquiring foreign citizenship for NRIs >> • Loss of Indian Citizenship - How you can lose your Indian Citizenship >>

Q663. Reduction of customs duty

on gold taken to India?

Question: Dear Virender Ji, From your website it appears that the govt has recently reduced the duty on gold bars from 10% to 6% + 3% tax -does this equate to total 6.18%? -Is there anywhere that I can get hold of the official notification that I can carry with me when travelling into Delhi-just in case they still want to still impose 10% -does the duty free allowance ( Rs 100,000 females/Rs. 50,000 males) apply to gold bars as well? an early reply will be highly appreciated. Anil Sood Australia Answer: I am not sure how you got the impression that customs duty on gold taken to India has been reduced from 10% to 6%? Perhaps, you are confusing gold bars with gold jewelery! 1. Passengers arriving in India with gold bars are charged customs duty @ 6 per cent ad valorem plus 3 per cent tax. 2. Passengers carrying gold jewelry are charged 10% customs duty plus 3% taxDuty Free Allowance

Duty free allowance, Rupees 100,000 for lady passengers and Rupees 50,000 for gentlemen applies to only gold jewelery.Printing out notifications as proof

To find official notifications you should go to the Indian customs website. However keep in mind that rules and regulations can be changed by the government of India at anytime. Quite often I find that some websites are not updated immediately and show outdated information. For example, even though a few customs websites still show that 10 Kg of gold can be brought in, the limit is 1 Kg. Any passenger who decides on the basis of the information posted on some website, even if it is a government website, to take 10 Kg of gold to India, is in for a rude awakening! a printout from a website would be of no use under such circumstances. Ignorance of the law is never accepted as an excuse. On April 18, 2012 the government reduced the amount allowed to 1 Kg. Many websites still continue to show 10Kg! To see the government notification CLICK HERE Readers should check and confirm what they read on any website, including my website, before acting on the information provided! • Disadvantage of acquiring foreign citizenship by NRIs settled abroad >> • Advantages of acquiring foreign citizenship for NRIs >> • Loss of Indian Citizenship - How you can lose your Indian Citizenship >>

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com

NriInformation FAQ

Read Disclaimer at bottom of page