Renting Property in India - Benefits of Leave & License agreements

Tips when giving property on Leave and License

1. Don't let out your property to anyone unless you check the person who is renting the property. While it is not possible in India to get background check done easily, you could take some precautions, such as checking the person's employment record, previous address etc. 2. Don't hand over your property in trust and good faith to anyone regardless of how well they impress you, without checking proper documentation and finding out who exactly is going to occupy your property. When renting to a foreigner, local police should be informed. This is now required by law in many cities. 3. Use a professional to draft the agreement. A lawyer is preferable than a real estate brokers who have a pre written template for an agreement and just fill in the blanks. 4. Pay the required stamp duty for your agreement and register it legally. Unless the agreement is registered, you have no protection. 5. If property is located in a society, then take a No Objection Certificate (NOC) from the society so as to avoid problems in future. 6. It may be advisable to enter into an agreement of only eleven months, and renew if you find things are working out well for you. 7. In cases where a rental agent, such as a broker brings the client, you may consider adding in the agreement that no further brokerage will be paid, if and when the license agreement is renewed. Brokers in India normally charge one month rent as their fee.Difference between Agreement and Leave and License

Repatriation of Rental Income

Non resident Indians and PIO’s who rent their properties in India can easily repatriate the rental income to their countries of residence once due taxes on rental income are paid. Rental prices in major cities have increased quite a bit. Many reputable companies also rent flats and houses to keep as guest residences as hotel prices in India have risen considerably.

Calculating capital gains on sale of property in India

Purchasing Property in India . . . Check documents!

NRI - OCI - PIO Guide & Information

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a

professional accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation

between what has been stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

Renting Property in India - Benefits

of Leave & License agreements

Tips when giving property on Leave and License

1. Don't let out your property to anyone unless you check the person who is renting the property. While it is not possible in India to get background check done easily, you could take some precautions, such as checking the person's employment record, previous address etc. 2. Don't hand over your property in trust and good faith to anyone regardless of how well they impress you, without checking proper documentation and finding out who exactly is going to occupy your property. When renting to a foreigner, local police should be informed. This is now required by law in many cities. 3. Use a professional to draft the agreement. A lawyer is preferable than a real estate brokers who have a pre written template for an agreement and just fill in the blanks. 4. Pay the required stamp duty for your agreement and register it legally. Unless the agreement is registered, you have no protection. 5. If property is located in a society, then take a No Objection Certificate (NOC) from the society so as to avoid problems in future. 6. It may be advisable to enter into an agreement of only eleven months, and renew if you find things are working out well for you. 7. In cases where a rental agent, such as a broker brings the client, you may consider adding in the agreement that no further brokerage will be paid, if and when the license agreement is renewed. Brokers in India normally charge one month rent as their fee.Difference between Agreement and

Leave and License

Repatriation of Rental Income

Non resident Indians and PIO’s who rent their properties in India can easily repatriate the rental income to their countries of residence once due taxes on rental income are paid. Rental prices in major cities have increased quite a bit. Many reputable companies also rent flats and houses to keep as guest residences as hotel prices in India have risen considerably.

Disclaimer: Information provided is for general knowledge only and should not be

deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do

change from time to time. Please note that in case of any variation between what has

been stated on this website and the relevant Act, Rules, Regulations, Policy Statements

etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

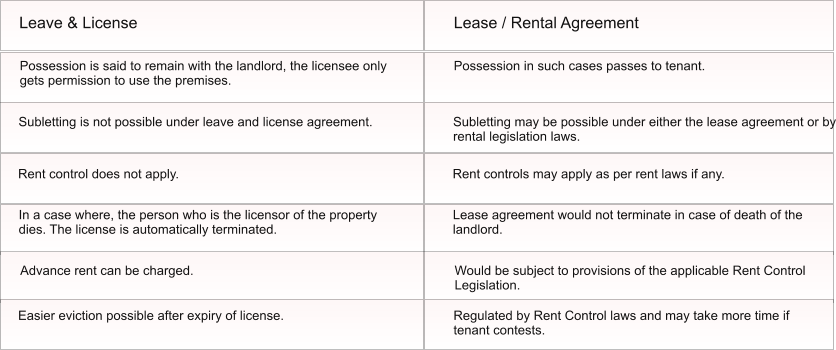

Leave & License

Rental Agreement

Possession is said to

remain with the landlord,

the licensee only gets

permission to use the

premises.

Subletting is not possible

under leave and license

agreement.

Rent control does not

apply.

In a case where, the

person who is the

licensor of the property

dies. The license is

automatically terminated.

Advance rent can be

charged.

Easier eviction possible

after expiry of license.

Possession in such

cases passes to tenant.

Subletting may be

possible under either the

lease agreement or by

rental legislation laws.

Rent controls may apply

as per rent laws if any.

Lease agreement would

not terminate in case of

death of the landlord.

Would be subject to

provisions of the

applicable Rent Control

Legislation.

Regulated by Rent

Control laws and may

take more time if tenant

contests.