Hidden costs charged by airlines in India as fees!

Advertised Airfare Rupees 499 - Buyer Pays Rupees 2924 !

So how does a customer attracted by an advertised airfare of Rupees 499 for a direct flight from Mumbai to Delhi end up being charged Rupees 2924? Before you jump to conclusions and blame travel agents in India who may have ripped off unsuspecting foreign tourists or not so savvy travelers. Checkout how airfares are advertised and what the flyer’s end up finally paying for their ticket.Cheap Airline tickets advertised in India

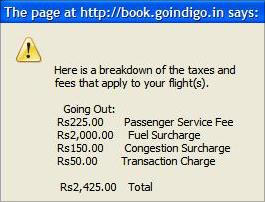

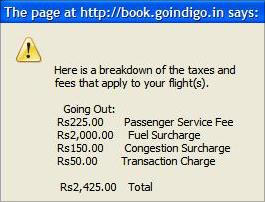

I am sure most of you must have seen those cheap and often unbelievable airfares advertised in India. Are they really true and are they really bargains? Fares as low as Rupees 499 are advertised quite often. You could find such a fare or even lower airfare right now on the web. Of course most of these advertised fares, conveniently do not add the taxes to show you the full price and here lies the catch in such discount airfares. Potential foreign tourists visiting India or NRIs living abroad of course are accustomed to the idea that tax is always based on the cost of the purchase price. In the west, taxes are usually a small percentage of the total purchase price. For example anywhere from 3 to 15 percent. So for an advertised airfare of Rs 499 one would unsuspectingly expect that even if the tax was a hefty 20 percent, the total airfare cost for him would be around Rupees 599. (Rs 499 for the airfare plus Rs 100 tax) People are accustomed to paying taxes worldwide when making purchases as they all assume that the tax collected is sent to the government. The seller does not get to keep the tax. In India however, when it comes to taxes on airfares there seems to be a slight difference. Let me give you an example. Rs 499 Airfare Costs Rs 2924, I checked out the airfare on two of India's discount airlines Indigo and Spice Jet. Today is April 11, 2008 as I write this, so I selected June 11, 2008 as my travel date on one of India's most popular and competitive air route Mumbai to Delhi. I found the cheapest ticket for a one way flight from Mumbai to Delhi offered at Rupees 499 by both Indigo airlines and Spice Jet airlines. NOTICE THE QUOTED FARE OF Rs 499 BECOMES Rs 2924 WHEN TAXES ARE ADDED. To be fair with Indigo airlines I want to make it clear that many airlines are following such a tax structure in India. Spicejet had the same and I would assume others do also. I am sure you are curious how we end up with taxes and fees of Rs 2425. Indigo's website gives the following breakdown.Ticket Cost: Rs 499 Tax Rs 2425 !

I wonder how much of the taxes or fees collected from passengers is going to the Government of India? Rs 225 is shown as 'Passenger Service Fee' I would assume that the airline would keep the service fee. As this amount is NOT shown as tax. Rs 2,000 Charged as a 'Fuel Surcharge' one would assume is for the airline. Rs 150 is shown as a 'Congestion Surcharge' Not as a tax Rs 50 shown as a 'Transaction Charge' I hear is being charged as a few for booking your airline ticket on the Internet. One would assume that airlines would be happy with Internet bookings as they save the travel agents commission. Notice something strange in the figures above. There does not be a specific mention of the amount of 'TAX' on the Ticket Price. So how much is the real tax on airline tickets in India? All I can see under their taxes and fee component are fees. I started to wonder what first class passengers are paying in taxes for the same flight. As Indigo does not have a business or first class, I logged into the Jet airlines website. What I found really surprised me.Ticket Cost Rs 14950 Tax 2375

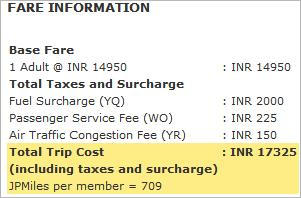

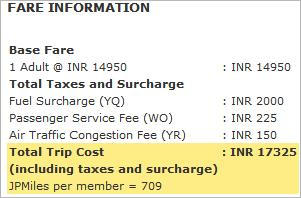

When I checked Jet Airlines airfare for the same route and day, I found that their Premier class ticket was priced at Rs 14,950 plus of course tax. Their website showed a tax of only Rs 2375 added on to their ticket of Rs 14,950. For a few minutes I was quite confused as to why tax on a ticket costing Rs 499 was being charged a tax of Rs 2425 by Indigo airlines, where as Jet airlines was showing a tax of Rupees 2375 on a ticket priced at Rs 14,950. On checking further I found that Indigo had added a new charge of Rs 50 for booking tickets on their website. Some airlines are now charging customers to book tickets on the Internet. Jet airlines has not charged for web booking. Hence the tax they showed was Rs 50 cheaper than what Indigo airlines showed. It seems the cost price of your airline ticket is does not seem to matter when it comes to tax on airfares in India. Which makes me to wonder what percentage of tax does the Indian government collect on airfares in India? Are airlines keeping money collected under the taxes category for themselves? One would think that those traveling in a higher premium class and paying almost thirty times what a discount ticket flyer is paying would also be paying a higher airfare tax. Apparently this does not appear to be the case in India. Next time you check airfares on the Internet compare the taxes charged by different companies. When you see advertisements for airline tickets that say plus tax, make it a point to check the tax component carefully.

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a

professional accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation

between what has been stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

Taking gold to India when visiting India | Take jewelery to India

Customs duty on gold jewelery taken to India . . . Taking gold to India

Quick Links - Gold articles - read now!

NRI - OCI - PIO Guide & Information

Hidden costs

charged by

airlines in India as fees!

Advertised Airfare Rupees 499 Buyer

Pays Rupees 2924!

So how does a customer attracted by an advertised airfare of Rupees 499 for a direct flight from Mumbai to Delhi end up being charged Rupees 2924? Before you jump to conclusions and blame travel agents in India who may have ripped off unsuspecting foreign tourists or not so savvy travelers. Checkout how airfares are advertised and what the flyer’s end up finally paying for their ticket.Cheap Airline tickets advertised in

India

I am sure most of you must have seen those cheap and often unbelievable airfares advertised in India. Are they really true and are they really bargains? Fares as low as Rupees 499 are advertised quite often. You could find such a fare or even lower airfare right now on the web. Of course most of these advertised fares, conveniently do not add the taxes to show you the full price and here lies the catch in such discount airfares. Potential foreign tourists visiting India or NRIs living abroad of course are accustomed to the idea that tax is always based on the cost of the purchase price. In the west, taxes are usually a small percentage of the total purchase price. For example anywhere from 3 to 15 percent. So for an advertised airfare of Rs 499 one would unsuspectingly expect that even if the tax was a hefty 20 percent, the total airfare cost for him would be around Rupees 599. (Rs 499 for the airfare plus Rs 100 tax) People are accustomed to paying taxes worldwide when making purchases as they all assume that the tax collected is sent to the government. The seller does not get to keep the tax. In India however, when it comes to taxes on airfares there seems to be a slight difference. Let me give you an example. Rs 499 Airfare Costs Rs 2924, I checked out the airfare on two of India's discount airlines Indigo and Spice Jet. Today is April 11, 2008 as I write this, so I selected June 11, 2008 as my travel date on one of India's most popular and competitive air route Mumbai to Delhi. I found the cheapest ticket for a one way flight from Mumbai to Delhi offered at Rupees 499 by both Indigo airlines and Spice Jet airlines. NOTICE THE QUOTED FARE OF Rs 499 BECOMES Rs 2924 WHEN TAXES ARE ADDED. To be fair with Indigo airlines I want to make it clear that many airlines are following such a tax structure in India. Spicejet had the same and I would assume others do also. I am sure you are curious how we end up with taxes and fees of Rs 2425. Indigo's website gives the following breakdown.Ticket Cost: Rs 499 Tax Rs 2425 !

I wonder how much of the taxes or fees collected from passengers is going to the Government of India? Rs 225 is shown as 'Passenger Service Fee' I would assume that the airline would keep the service fee. As this amount is NOT shown as tax. Rs 2,000 Charged as a 'Fuel Surcharge' one would assume is for the airline. Rs 150 is shown as a 'Congestion Surcharge' Not as a tax Rs 50 shown as a 'Transaction Charge' I hear is being charged as a few for booking your airline ticket on the Internet. One would assume that airlines would be happy with Internet bookings as they save the travel agents commission. Notice something strange in the figures above. There does not be a specific mention of the amount of 'TAX' on the Ticket Price. So how much is the real tax on airline tickets in India? All I can see under their taxes and fee component are fees. I started to wonder what first class passengers are paying in taxes for the same flight. As Indigo does not have a business or first class, I logged into the Jet airlines website. What I found really surprised me.Ticket Cost Rs 14950 Tax 2375

When I checked Jet Airlines airfare for the same route and day, I found that their Premier class ticket was priced at Rs 14,950 plus of course tax. Their website showed a tax of only Rs 2375 added on to their ticket of Rs 14,950. For a few minutes I was quite confused as to why tax on a ticket costing Rs 499 was being charged a tax of Rs 2425 by Indigo airlines, where as Jet airlines was showing a tax of Rupees 2375 on a ticket priced at Rs 14,950. On checking further I found that Indigo had added a new charge of Rs 50 for booking tickets on their website. Some airlines are now charging customers to book tickets on the Internet. Jet airlines has not charged for web booking. Hence the tax they showed was Rs 50 cheaper than what Indigo airlines showed. It seems the cost price of your airline ticket is does not seem to matter when it comes to tax on airfares in India. Which makes me to wonder what percentage of tax does the Indian government collect on airfares in India? Are airlines keeping money collected under the taxes category for themselves? One would think that those traveling in a higher premium class and paying almost thirty times what a discount ticket flyer is paying would also be paying a higher airfare tax. Apparently this does not appear to be the case in India. Next time you check airfares on the Internet compare the taxes charged by different companies. When you see advertisements for airline tickets that say plus tax, make it a point to check the tax component carefully.

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com