Calculate Capital Gains If Property Sold was bought before 1980

How to calculate Fair Market Value of Property - Capital gains on property purchased before 1981

When it comes to calculating long term capital gains on property the cost inflation index for the financial year of purchase and sale helps and to a large extent reduces the seller’s tax liability in most cases. Cost Inflation Index is a measure of inflation under Section 48 of the Income-Tax Act. While it is fairly easy to calculate long term capital gains on property that was purchased from 1981 onwards, as cost inflation index chart is available from the financial year 1981-1982 onwards, the problem many are faced with is when property sale involves property that was acquired prior to the 1981-1982 financial year. To calculate the long term capital gain on property that was acquired prior to April 1981, here is what can be done in such cases: The first step is for the seller to calculate what would be the fair market value of the property if it was to be sold on April 1, 1981.How to Calculate Fair Market Value of Property

The calculation of fair market value of property in India is required to calculate long term capital gains in India, generally when property has been purchased in earlier years where no cost inflation index numbers are available. This applies to properties purchased before April 1, 1981. So how does a seller calculate the fair market price of a property that was purchased a long time ago, perhaps he/she inherited the property and have no idea of what it should have been worth on April 1, 1981. The most common method to calculate fair market value is to figure out what similar properties were selling for at that time. This type of information can be ascertained from the registration offices. A little bit of home work would be required. Since no two properties would be exactly the same, some give and take would be required. Property valuation is based not only on the property size, but location, improvements, amenities etc. So comparable method can be used as a guideline and then add or subtract accordingly. If this is something that sounds complicated, then there is a simpler method. Use a valuer!Government Approved Valuer

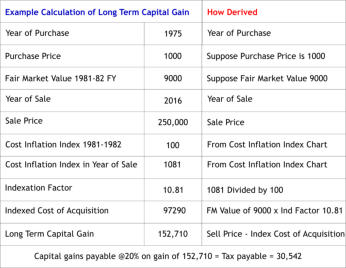

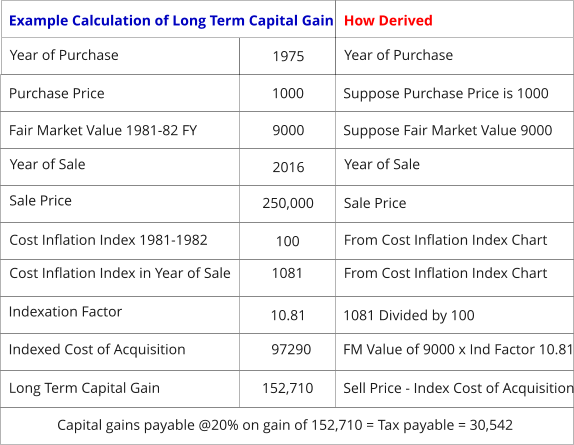

There are several government approved property valuer’s in most major cities, hire a valuer to ascertain the fair market price of the property and provide you with the documentation of their evaluation. Once you have the fair market value worked out for your property. The long term capital gain can be easily calculated. Use the fair market value to calculate the cost of acquisition using the 1981 Index inflation number, which is 100.Example of Calculating Long Term Capital Gains for Property that was purchased before 1981.

For more detailed article on ‘Step by step calculation of capital gains tax’ and complete cost inflation Index chart up to the financial year 2016 check the two links provided below: How to calculate capital gains on property sold in India - Saving on capital gains http://nriinformation.com/faq3/

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has

been stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

NRI

NRI - OCI - PIO Guide & Information

© Copyright 2006 Nriinformation.com

Calculate Capital Gains If

Property Sold was bought

before 1980

How to calculate Fair Market Value

of Property - Capital gains on

property purchased before 1981

When it comes to calculating long term capital gains on property the cost inflation index for the financial year of purchase and sale helps and to a large extent reduces the seller’s tax liability in most cases. Cost Inflation Index is a measure of inflation under Section 48 of the Income-Tax Act. While it is fairly easy to calculate long term capital gains on property that was purchased from 1981 onwards, as cost inflation index chart is available from the financial year 1981-1982 onwards, the problem many are faced with is when property sale involves property that was acquired prior to the 1981-1982 financial year. To calculate the long term capital gain on property that was acquired prior to April 1981, here is what can be done in such cases: The first step is for the seller to calculate what would be the fair market value of the property if it was to be sold on April 1, 1981.How to Calculate Fair Market Value

of Property

The calculation of fair market value of property in India is required to calculate long term capital gains in India, generally when property has been purchased in earlier years where no cost inflation index numbers are available. This applies to properties purchased before April 1, 1981. So how does a seller calculate the fair market price of a property that was purchased a long time ago, perhaps he/she inherited the property and have no idea of what it should have been worth on April 1, 1981. The most common method to calculate fair market value is to figure out what similar properties were selling for at that time. This type of information can be ascertained from the registration offices. A little bit of home work would be required. Since no two properties would be exactly the same, some give and take would be required. Property valuation is based not only on the property size, but location, improvements, amenities etc. So comparable method can be used as a guideline and then add or subtract accordingly. If this is something that sounds complicated, then there is a simpler method. Use a valuer!Government Approved Valuer

There are several government approved property valuer’s in most major cities, hire a valuer to ascertain the fair market price of the property and provide you with the documentation of their evaluation. Once you have the fair market value worked out for your property. The long term capital gain can be easily calculated. Use the fair market value to calculate the cost of acquisition using the 1981 Index inflation number, which is 100.Example of Calculating Long Term

Capital Gains for Property that was

purchased before 1981.

For more detailed article on ‘Step by step calculation of capital gains tax’ and complete cost inflation Index chart up to the financial year 2016 check the two links provided below: How to calculate capital gains on property sold in India - Saving on capital gains http://nriinformation.com/faq3/