Q578. Pay 1% TDS on Purchase of Property in India . . .

Question: Dear Sir, I have bought a under construction Flat in Pune from a reputed builder in Dec 2011. So far I have paid close to 50% of the total amount based on the site progress. I have now received a mail from them advising me on the TDS mentioned. As per the mail, I can directly pay tax of 1% on payments that I will be making henceforth & pay 99% to the Builder, ELSE pay 100% to the Builder & he in turn pays 1% tax to Govt. I request for your advise on the following points. A) Is this TDS applicable for NRIs? I am an NRI & have been NRI for more than 6 years before the Property Purchase (Dec 2011). I have already paid the Stamp Duty & Registration Charges for my Flat. B) Being an NRI, please advise the easiest mode of payment (whether direct or through builder), in case we need to pay. Thanking you in anticipation. Regards Answer: TDS payable on property purchases in India came into effect as of June 1, 2013 when Section 194-IA came into effect. (See Excerpt**). Regarding your questions A & B: • TDS is applicable to NRIs also. You state in your email that you have already paid for registration & stamp duty charges! Has the property been registered in your name already? Normally at the time of Registration, the Registrar would check that TDS has been paid if property price is over Rupees 50 Lakh. • The onus of paying this type of TDS is on the buyer! they need to deduct the required TDS before making payment to the seller of the property. Builder may accept the payment, however if they fail to pay the purchaser would still be liable. o The tax required to be deducted if seller provides their PAN number is 1% on the purchase price when the price exceeds 50 lakh Rupees. o If seller does not provide PAN info, then 20% TDS needs to be deducted. • On-line payments can be made from the Indian Tax Departments website. Form 26QB is required for payment of TDS on Sale of Property.

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has been

stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

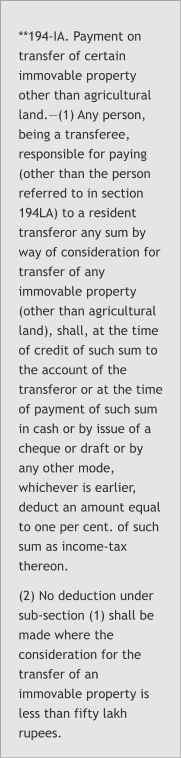

**194-IA. Payment on transfer of certain immovable

property other than agricultural land.—(1) Any person,

being a transferee, responsible for paying (other than the

person referred to in section 194LA) to a resident transferor

any sum by way of consideration for transfer of any

immovable property (other than agricultural land), shall, at

the time of credit of such sum to the account of the

transferor or at the time of payment of such sum in cash or

by issue of a cheque or draft or by any other mode,

whichever is earlier, deduct an amount equal to one per

cent. of such sum as income-tax thereon.

(2) No deduction under sub-section (1) shall be made

where the consideration for the transfer of an immovable

property is less than fifty lakh rupees.

NRI - OCI - PIO Guide & Information

NriInformation Questions &Answers

Read Disclaimer at bottom of page

Q578. Pay 1% TDS on Purchase of

Property in India . . .

Question: Dear Sir, I have bought a under construction Flat in Pune from a reputed builder in Dec 2011. So far I have paid close to 50% of the total amount based on the site progress. I have now received a mail from them advising me on the TDS mentioned. As per the mail, I can directly pay tax of 1% on payments that I will be making henceforth & pay 99% to the Builder, ELSE pay 100% to the Builder & he in turn pays 1% tax to Govt. I request for your advise on the following points. A) Is this TDS applicable for NRIs? I am an NRI & have been NRI for more than 6 years before the Property Purchase (Dec 2011). I have already paid the Stamp Duty & Registration Charges for my Flat. B) Being an NRI, please advise the easiest mode of payment (whether direct or through builder), in case we need to pay. Thanking you in anticipation. Regards Answer: TDS payable on property purchases in India came into effect as of June 1, 2013 when Section 194-IA came into effect. (See Excerpt**). Regarding your questions A & B: TDS is applicable to NRIs also. You state in your email that you have already paid for registration & stamp duty charges! Has the property been registered in your name already? Normally at the time of Registration, the Registrar would check that TDS has been paid if property price is over Rupees 50 Lakh. The onus of paying this type of TDS is on the buyer! they need to deduct the required TDS before making payment to the seller of the property. Builder may accept the payment, however if they fail to pay the purchaser would still be liable. The tax required to be deducted if seller provides their PAN number is 1% on the purchase price when the price exceeds 50 lakh Rupees. If seller does not provide PAN info, then 20% TDS needs to be deducted. On-line payments can be made from the Indian Tax Departments website. Form 26QB is required for payment of TDS on Sale of Property. For Form 26QB and e-Payment information, Click HERE

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com

NriInformation FAQ

Read Disclaimer at bottom of page