Q.886 Will window lose Railway pension on acquiring foreign citizenship

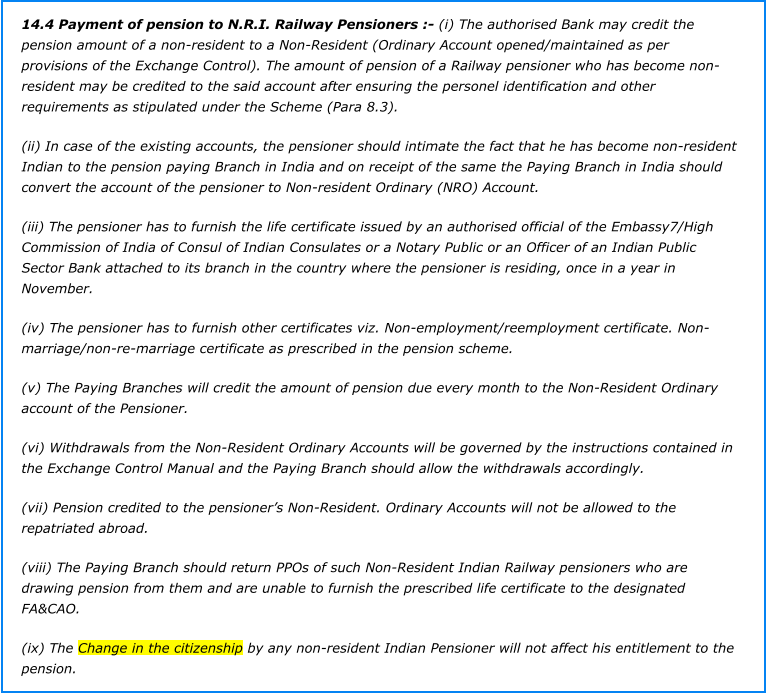

Hello I am a UK citizen wanting some urgent advice on behalf of a friend. She is currently getting a Widows Pension from the Indian Railways. She want to consider acquiring European Nationality and later take out an NRI or OCI so she can continue to live most of her time in India. Will taking up new nationality and obtaining NRI mean she would have to GIVE up her Indian Railways Widows Pension? Can you please advise who I need to contact to get a definitive answer? Can you please send me a link of any Railways rules where taking new nationality will prohibit continuing to claim a widows pension? Thank you. Kindest regards, Viona Answer: Pension to a widow comes under category 1 of Indian Family Pension and is available for lifetime or until remarriage. [In case of minor children in such a situation, pension benefit is available until age 25 or when they start earning, whichever is earlier] Becoming a non-resident (NRI) or acquiring foreign citizenship does not generally effect a person’s Indian pension entitlement. A window receiving pension from Indian Railways would however lose her pension if she remarries. Indian pensioners when they become non-resident are required to notify their pension paying bank of their NRI status and get their pension credited to a NRO bank account instead of a resident bank account. Additionally, NRI pensioners are required to furnish a life certificate issued by an authorized official of the Indian consulate in their area of residence. Life certificate is required once a year in November. Getting a life certificate from Indian consulate may sound complicated but it is a simple task that thousands of Indian pensioners living across the world get done routinely at Indian consulates. Regarding your questions: • Can you please advise who I need to contact to get a definitive answer? / Contact the pension paying authority, which would in this case be the Indian Railways. • Can you please send me a link of any Railways rules where taking new nationality will prohibit continuing to claim a widows pension? / Since I am not aware there is such a rule, I am unable to provide a link! But am providing an excerpt from http://www.indianrailways.gov.in

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has been

stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

Quick Links - Articles of interest of NRIs - OCIs - PIO

N

RI

Taxes on Indian Pension in the United States . . .

Pension received from India not taxable in Canada . . .

Seniors Think Twice before moving abroad! . . .

NRI - OCI - PIO Guide & Information

NriInformation Questions &Answers

Read Disclaimer at bottom of page

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com

Q.886 Will window lose Railway

pension on acquiring foreign

citizenship

Hello I am a UK citizen wanting some urgent advice on behalf of a friend. She is currently getting a Widows Pension from the Indian Railways. She want to consider acquiring European Nationality and later take out an NRI or OCI so she can continue to live most of her time in India. Will taking up new nationality and obtaining NRI mean she would have to GIVE up her Indian Railways Widows Pension? Can you please advise who I need to contact to get a definitive answer? Can you please send me a link of any Railways rules where taking new nationality will prohibit continuing to claim a widows pension? Thank you. Kindest regards, Viona Answer: Pension to a widow comes under category 1 of Indian Family Pension and is available for lifetime or until remarriage. [In case of minor children in such a situation, pension benefit is available until age 25 or when they start earning, whichever is earlier] Becoming a non-resident (NRI) or acquiring foreign citizenship does not generally effect a person’s Indian pension entitlement. A window receiving pension from Indian Railways would however lose her pension if she remarries. Indian pensioners when they become non-resident are required to notify their pension paying bank of their NRI status and get their pension credited to a NRO bank account instead of a resident bank account. Additionally, NRI pensioners are required to furnish a life certificate issued by an authorized official of the Indian consulate in their area of residence. Life certificate is required once a year in November. Getting a life certificate from Indian consulate may sound complicated but it is a simple task that thousands of Indian pensioners living across the world get done routinely at Indian consulates. Regarding your questions: • Can you please advise who I need to contact to get a definitive answer? / Contact the pension paying authority, which would in this case be the Indian Railways. • Can you please send me a link of any Railways rules where taking new nationality will prohibit continuing to claim a widows pension? / Since I am not aware there is such a rule, I am unable to provide a link! But am providing an excerpt from http://www.indianrailways.gov.in

14.4 Payment of pension to N.R.I.

Railway Pensioners :- (i) The authorised

Bank may credit the pension amount of a

non-resident to a Non-Resident (Ordinary

Account opened/maintained as per

provisions of the Exchange Control). The

amount of pension of a Railway pensioner

who has become non-resident may be

credited to the said account after ensuring

the personel identification and other

requirements as stipulated under the

Scheme (Para 8.3).

(ii) In case of the existing accounts, the

pensioner should intimate the fact that he

has become non-resident Indian to the

pension paying Branch in India and on

receipt of the same the Paying Branch in

India should convert the account of the

pensioner to Non-resident Ordinary (NRO)

Account.

(iii) The pensioner has to furnish the life

certificate issued by an authorised official

of the Embassy7/High Commission of

India of Consul of Indian Consulates or a

Notary Public or an Officer of an Indian

Public Sector Bank attached to its branch

in the country where the pensioner is

residing, once in a year in November.

(iv) The pensioner has to furnish other

certificates viz. Non-

employment/reemployment certificate.

Non-marriage/non-re-marriage certificate

as prescribed in the pension scheme.

(v) The Paying Branches will credit the

amount of pension due every month to the

Non-Resident Ordinary account of the

Pensioner.

(vi) Withdrawals from the Non-Resident

Ordinary Accounts will be governed by the

instructions contained in the Exchange

Control Manual and the Paying Branch

should allow the withdrawals accordingly.

(vii) Pension credited to the pensioner’s

Non-Resident. Ordinary Accounts will not

be allowed to the repatriated abroad.

(viii) The Paying Branch should return

PPOs of such Non-Resident Indian Railway

pensioners who are drawing pension from

them and are unable to furnish the

prescribed life certificate to the designated

FA&CAO.

(ix) The Change in the citizenship by any

non-resident Indian Pensioner will not

affect his entitlement to the pension.

NriInformation FAQ

Read Disclaimer at bottom of page