Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has been

stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

NRI

Filing Requirements for U.S. Citizens in India

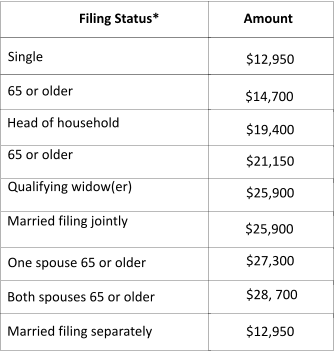

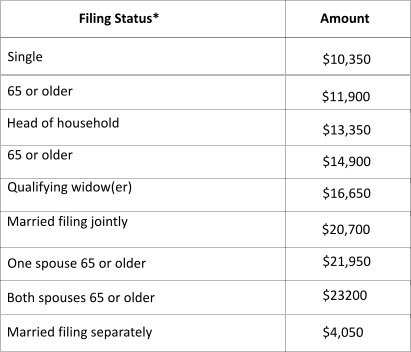

The rules for filing U.S. tax returns remain the same for U.S. citizens and resident aliens, regardless of whether they are residing abroad or in the United States. Those who hold 'Green Cards' are resident aliens, and the same tax rules that apply to U.S. citizens, generally also apply to green card holders. Rules for filing income, estate, gift tax returns and for paying estimated tax, are generally the same whether you are in the United States, India, or any other part of the world. Generally, your income, filing status, and age determine whether you must file an income tax return. The requirement for filing a return for the year 2016 is that your gross income from worldwide sources is at least the amount shown for your filing status in table. Please note that the table is provided for informational purpose only, check with the IRS to ensure that there are no errors or omissions on our page or if the amounts mentioned here have changed. Check the IRS website for the latest information on filling requirements. Their website address is http://www.irs.govSelf Employed Persons

Those who are self-employed are required to file a U.S. income tax return if they had $400 or more of net earnings from self- employment, regardless of their age. Net earnings from self- employment include income earned both in a foreign country and in the United States. Check the IRS website for the latest information on filling requirements. Their website address is http://www.irs.gov *(Source: IRS Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad.)US Citizens living abroad benefit by filling taxes

The tax agreement between India and the United States may reduce or eliminate any double taxation of your income. The IRS allows credits for foreign income taxes you pay, while living outside the United States. These credits may offset any U.S. tax you might owe on your Indian income. However, to claim the credit you must file your U.S. tax return, every year. Not filling your US taxes can only increase your tax liability. Suppose you live in India for 5 years and then return to the United States. The IRS may question your failure to file returns for the past five years, in such cases; they normally make assessments based on their best estimate of your income. The interest and penalties on any old tax amounts accumulates rapidly. In a few years you may end up owing a lot more than the original taxes owed. Voluntarily filing as opposed to the IRS coming to you, can make a big difference in how you will get treated when penalties are assessed, for failing to file U.S. tax returns. New foreign account reporting requirements are being phased over the next few years, making it ever tougher to hide income in foreign countries. The IRS is now focusing on banks and bankers worldwide in an effort to find U.S. taxpayers who may be hiding assets overseas.

NRI - OCI - PIO Guide & Information

Filing Requirements for U.S.

Citizens in India

The rules for filing U.S. tax returns remain the same for U.S. citizens and resident aliens, regardless of whether they are residing abroad or in the United States. Those who hold 'Green Cards' are resident aliens, and the same tax rules that apply to U.S. citizens, generally also apply to green card holders. Rules for filing income, estate, gift tax returns and for paying estimated tax, are generally the same whether you are in the United States, India, or any other part of the world. Generally, your income, filing status, and age determine whether you must file an income tax return. The requirement for filing a return for the year 2022 is that your gross income from worldwide sources is at least the amount shown for your filing status in table. Please note that the table is provided for informational purpose only, check with the IRS to ensure that there are no errors or omissions on our page or if the amounts mentioned here have changed. Check the IRS website for the latest information on filling requirements. Their website address is http://www.irs.govSelf Employed Persons

Those who are self-employed are required to file a U.S. income tax return if they had $400 or more of net earnings from self-employment, regardless of their age. Net earnings from self-employment include income earned both in a foreign country and in the United States. Check the IRS website for the latest information on filling requirements. Their website address is http://www.irs.gov *(Source: IRS Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad.)US Citizens living abroad benefit by

filling taxes

The tax agreement between India and the United States may reduce or eliminate any double taxation of your income. The IRS allows credits for foreign income taxes you pay, while living outside the United States. These credits may offset any U.S. tax you might owe on your Indian income. However, to claim the credit you must file your U.S. tax return, every year. Not filling your US taxes can only increase your tax liability. Suppose you live in India for 5 years and then return to the United States. The IRS may question your failure to file returns for the past five years, in such cases; they normally make assessments based on their best estimate of your income. The interest and penalties on any old tax amounts accumulates rapidly. In a few years you may end up owing a lot more than the original taxes owed. Voluntarily filing as opposed to the IRS coming to you, can make a big difference in how you will get treated when penalties are assessed, for failing to file U.S. tax returns. New foreign account reporting requirements are being phased over the next few years, making it ever tougher to hide income in foreign countries. The IRS is now focusing on banks and bankers worldwide in an effort to find U.S. taxpayers who may be hiding assets overseas. Next Page : U.S. Citizens having bank accounts in India . . . read now >>

$13,950

$15,700

© Copyright 2006 Nriinformation.com

N

RI Information

Informing

educating and connecting Indians across the globe