Q.860 Income tax liability for new green card holders

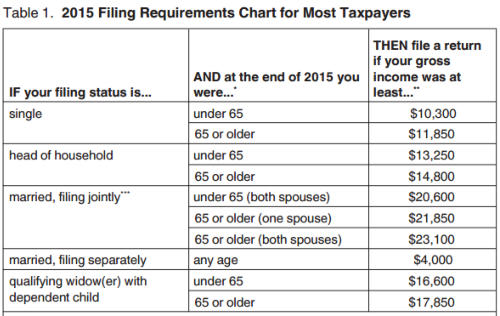

Question: Dear Mr V. Chand, I have found your website very informative, covering diverse area of concern & very useful. My hearty congratulations for creating such a wonderful web site. We, me & my wife (both Indian Citizen) applied for change in status in Aug 2015 when we were in US with my daughter. We travelled to India in first week of Nov2015 after obtaining Advance perole documents. Subsequently,green cards were received at USA address in 3rd week of Nov 2015. We are now planning to travel to US in last week of April 2016 & stay in Us for 6.5 months. As of today we are not 100% sure of staying in US permenantly. If situation do not suit us we may consider abondoning green card. We have investment in stocks, mutual fund, fixed deposits,insurance policies & hold few Bank Accounts & Dmat accounts. I am filing tax returns in india regularly. I have following questions: 1.When I will have to file Income Tax return in US? Is it necessary to file return even if I have no income in US?Is it OK if we file tax return in US for FY 2017 skipping filing tax returns in US for FY 2016? 2. Do we have to change our Bank Accounts & Dmat account in India to NRO account before leaving India or we can do it in Nov 2016 when we return to India.At this point of time we would have decided on our continuing of green card status. 3. the remitance received against insuance sheme are taxfree in India. How it will be treated in US tax regime? 4. If we are holding Stocks(equity) for more than 6 months, does Dividend received in India becomes taxable in US? Regards, S. Chandra [February 23, 2016] Answer: Regarding your questions: 1. The obligation to file a US tax return comes into effect when a person becomes a US tax resident. Once a person gets a green card he/she automatically becomes a U.S. tax resident. Starting with the year a person gets a green card, there is a requirement to declare worldwide income. Whether an individual is required to file a federal income tax return for a particular year generally depends whether they meet the US tax filling threshold. The requirement to file federal tax return in USA is based on a persons total earned income, the source of that income, age etc. See Table below: If income is below filing threshold for a particular taxation year, then in most cases there is no requirement to file a tax return for that year. Ex: A single person who is under 65 years of age and has income of less than $10,300 may not have to file a tax return for 2015. 2. Once a person becomes non-resident in India they are required by law to change their resident accounts to reflect their non-resident status. It is actually illegal to continue to hold resident savings accounts etc. after becoming NRI. While there is no period defined for bank accounts etc to be changed from resident to NRO, this should be done within a reasonable time. 3. I am not sure what you mean in #3 as ‘remitance received against insuance sheme’ ??? Generally under tax treaties income such as pension or annuity is taxed by the countries of the persons residence, unless specific changes are made in DTAA treaties of two countries. For example DTAA may specify that government pensions/annuities or social security payments in some cases may be taxable by the government making the payments. 4. Types of Income in India that would be subject to tax in USA Interest on bank deposits and other securities held in India Dividends from shares and mutual funds Capital gains from sale of assets Capital gains from sale of assets Agricultural income [Even though not taxable in India would be taxable in USA] Any type of salary or earned income When tax has been paid in India, credit under the DTAA would be allowed when filing US taxes. This website is not meant to offer tax advice, readers should seek the advice of a income tax professional familiar with US Tax Laws to ensure they stay in compliance of US tax reporting and tax filling laws.

Disclaimer: Information provided is for general knowledge only and should not be deemed to be professional advice. For professional advice kindly consult a professional

accountant, immigration advisor or the Indian consulate. Rules and regulations do change from time to time. Please note that in case of any variation between what has been

stated on this website and the relevant Act, Rules, Regulations, Policy Statements etc. the latter shall prevail.

© Copyright 2006 Nriinformation.com

N

RI Information

Informing

educating and connecting Indians across the globe . . . by Virendar Chand

NriInformation Questions &Answers

Read Disclaimer at bottom of page

- How to get Drivers License in India

- How to get Ration Card in India

- How to get new Gas Connection in India

- How to get Nativity Certificate in India

- How to get Aadhaar Card in India

- How to use your foreign phone in India

- How to Safely Transfer Money to India

- How to send Power of Attorney to India

- How to get Proof of Address Card in India

- How to Change your Name Legally

N

RI Information

Informing

educating and connecting Indians across the globe

© Copyright 2006 Nriinformation.com

Q.860 Income tax liability for

new green card holders

Question: Dear Mr V. Chand, I have found your website very informative, covering diverse area of concern & very useful. My hearty congratulations for creating such a wonderful web site. We, me & my wife (both Indian Citizen) applied for change in status in Aug 2015 when we were in US with my daughter. We travelled to India in first week of Nov2015 after obtaining Advance perole documents. Subsequently,green cards were received at USA address in 3rd week of Nov 2015. We are now planning to travel to US in last week of April 2016 & stay in Us for 6.5 months. As of today we are not 100% sure of staying in US permenantly. If situation do not suit us we may consider abondoning green card. We have investment in stocks, mutual fund, fixed deposits,insurance policies & hold few Bank Accounts & Dmat accounts. I am filing tax returns in india regularly. I have following questions: 1.When I will have to file Income Tax return in US? Is it necessary to file return even if I have no income in US?Is it OK if we file tax return in US for FY 2017 skipping filing tax returns in US for FY 2016? 2. Do we have to change our Bank Accounts & Dmat account in India to NRO account before leaving India or we can do it in Nov 2016 when we return to India.At this point of time we would have decided on our continuing of green card status. 3. the remitance received against insuance sheme are taxfree in India. How it will be treated in US tax regime? 4. If we are holding Stocks(equity) for more than 6 months, does Dividend received in India becomes taxable in US? Regards, S. Chandra [February 23, 2016] Answer: Regarding your questions: 1. The obligation to file a US tax return comes into effect when a person becomes a US tax resident. Once a person gets a green card he/she automatically becomes a U.S. tax resident. Starting with the year a person gets a green card, there is a requirement to declare worldwide income. Whether an individual is required to file a federal income tax return for a particular year generally depends whether they meet the US tax filling threshold. The requirement to file federal tax return in USA is based on a persons total earned income, the source of that income, age etc. See Table below: If income is below filing threshold for a particular taxation year, then in most cases there is no requirement to file a tax return for that year. Ex: A single person who is under 65 years of age and has income of less than $10,300 may not have to file a tax return for 2015. 2. Once a person becomes non-resident in India they are required by law to change their resident accounts to reflect their non- resident status. It is actually illegal to continue to hold resident savings accounts etc. after becoming NRI. While there is no period defined for bank accounts etc to be changed from resident to NRO, this should be done within a reasonable time. 3. I am not sure what you mean in #3 as ‘remitance received against insuance sheme’ ??? Generally under tax treaties income such as pension or annuity is taxed by the countries of the persons residence, unless specific changes are made in DTAA treaties of two countries. For example DTAA may specify that government pensions/annuities or social security payments in some cases may be taxable by the government making the payments. 4. Types of Income in India that would be subject to tax in USA Interest on bank deposits and other securities held in India Dividends from shares and mutual funds Capital gains from sale of assets Capital gains from sale of assets Agricultural income [Even though not taxable in India would be taxable in USA] Any type of salary or earned income When tax has been paid in India, credit under the DTAA would be allowed when filing US taxes. This website is not meant to offer tax advice, readers should seek the advice of a income tax professional familiar with US Tax Laws to ensure they stay in compliance of US tax reporting and tax filling laws.

NriInformation FAQ

Read Disclaimer at bottom of page